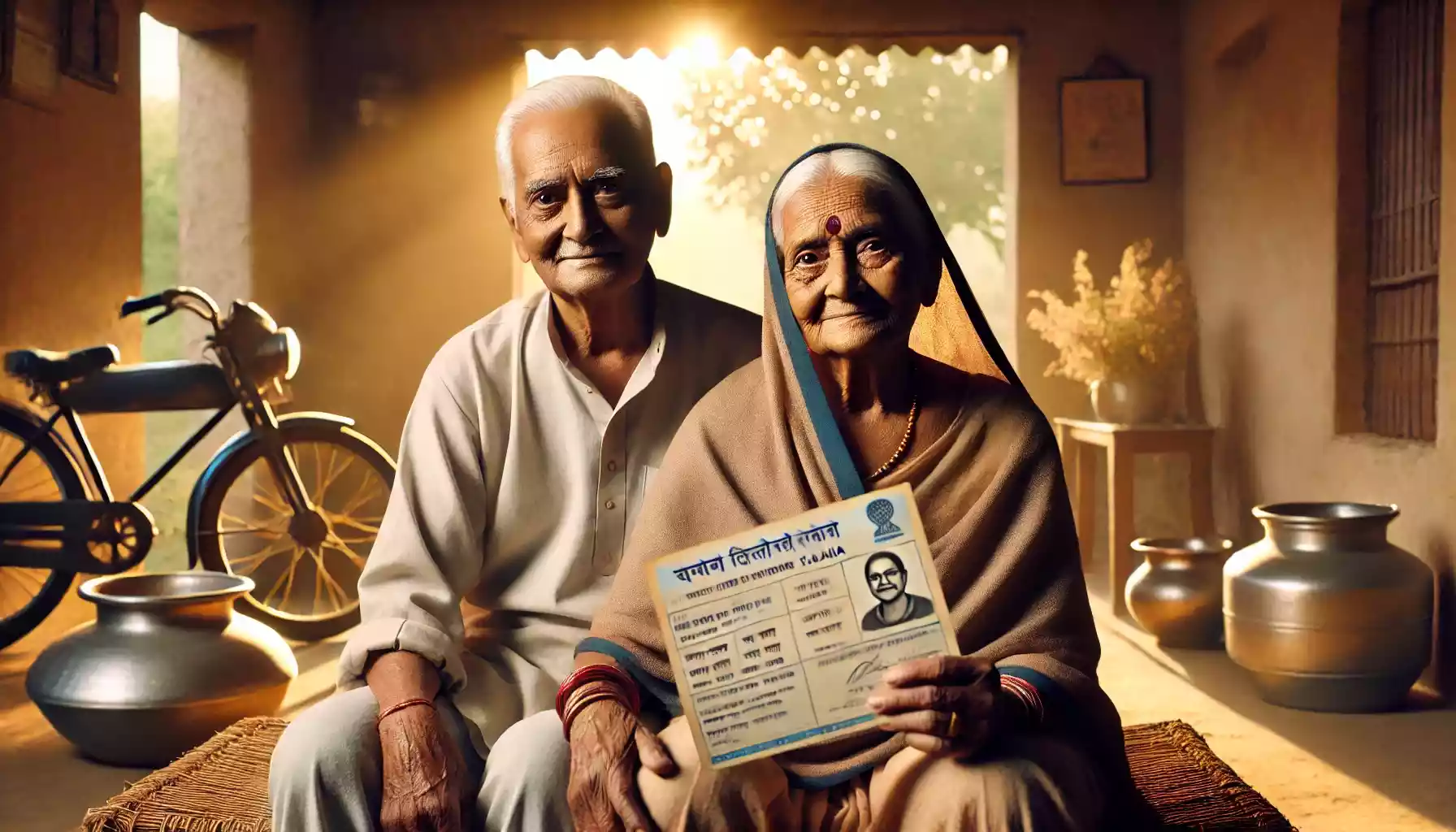

The Atal Pension Yojana (APY) is a government-backed pension scheme aimed at providing financial security to the unorganized sector workers after their retirement. Launched by the Government of India, the scheme is designed to ensure that individuals who do not have access to formal pension plans can still enjoy a steady income during their old age. The Atal Pension Yojana offers a guaranteed pension ranging from ₹1,000 to ₹5,000 per month, depending on the contribution made by the subscriber during their working years. This scheme is especially beneficial for those in the unorganized sector, such as laborers, small traders, and other low-income workers.

In this article, we will guide you through the process of registering for the Atal Pension Yojana, the eligibility criteria, the benefits of the scheme, and how you can ensure a secure and financially stable retirement.

What is Atal Pension Yojana and Its Benefits?

The Atal Pension Yojana was launched with the objective of providing a regular pension to individuals working in the unorganized sector. According to media reports, the scheme allows subscribers to receive a pension ranging from ₹1,000 to ₹5,000 per month, depending on the contribution made over the years. The scheme ensures that even after retirement, individuals can maintain their standard of living without depending on others. The government also contributes 50% of the total contribution or ₹1,000 per annum, whichever is lower, to the accounts of eligible subscribers for a period of five years.

Eligibility Criteria for Atal Pension Yojana

To be eligible for the Atal Pension Yojana, the applicant must be a citizen of India aged between 18 to 40 years. The subscriber must have a savings bank account and should not be part of any other statutory social security scheme like EPF, NPS, etc. Additionally, it is important that the individual has a valid mobile number linked with their bank account for easy communication and transactions related to the scheme.

How to Register for Atal Pension Yojana?

Registering for the Atal Pension Yojana is a simple process. To enroll, you need to visit your bank where you hold a savings account. You can either fill out the APY registration form available at the bank or download it from the official website of the scheme. After filling in your details, such as name, age, mobile number, and Aadhaar number, submit the form to the bank. The bank will then link your savings account to the APY scheme, and the monthly contribution will be automatically deducted from your account based on the pension amount you choose.

Securing Your Future with Atal Pension Yojana

Once you are successfully enrolled in the Atal Pension Yojana, your contributions will continue until you reach the age of 60. Upon reaching 60 years of age, you will start receiving the pension amount you opted for during the registration. This pension will be directly credited to your bank account every month, ensuring you have a steady income post-retirement.

The Atal Pension Yojana is an excellent initiative by the Government of India to provide financial security to those who lack access to formal pension schemes. If you or someone you know is working in the unorganized sector and is eligible for this scheme, it is highly advisable to register and start contributing as early as possible to secure a comfortable and financially stable retirement.

By taking advantage of the Atal Pension Yojana, you can ensure that your post-retirement years are financially secure, allowing you to live with dignity and peace of mind.